7 Simple Techniques For Insurance

Table of ContentsNot known Facts About InsuranceSome Ideas on Insurance You Need To KnowNot known Details About Insurance Excitement About InsuranceThe Best Strategy To Use For InsuranceAll about InsuranceThe Best Strategy To Use For InsuranceInsurance Things To Know Before You Get This

If you pick to do it on your very own, making the calls is the hardest component of the procedure. Yet it's a really vital action as well as there's no faster way. "Comparison shopping sites are truly just lead generation services," Clark says. "You have to go shopping separately with various insurance firms [by] calling them all." As insurance coverage is state regulated, Clark would love to see each state develop an online comparison-shopping device.Yet no state has actually stepped up to take on that job yet! When you obtain the quotes back, it's time to contrast them. Each auto insurance coverage quote must be based upon the same quantity of insurance coverage so you can do an apples-to-apples comparison. This is the most convenient part of finding out exactly how to purchase cars and truck insurance! Suppose a badly rated business supplies you an excellent quote? Clark says to prevent them! While the costs may be alluring, you wish to make sure your insurer is there for you when you need them.

The 9-Second Trick For Insurance

Great, low-cost car insurance is around; it just takes a little buying around to locate it! That's why it's so important that you know how to buy auto insurance policy. Whenever you're thinking about switching insurers, make sure to take notice of a business's document with consumer contentment and grievance resolution (insurance).

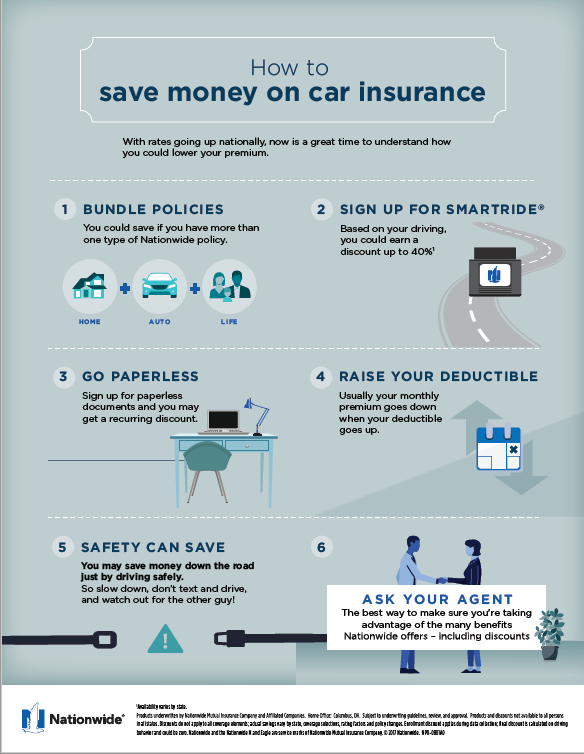

You're going shopping around for vehicle insurance coverage. Do you have a property owners or occupants insurance plan? If so, is it with the same insurance coverage company that provides your auto insurance policy?

A Biased View of Insurance

These insurance providers provide supposed multi-policy discount rates. Typically, these discount rates go to the very least 10% and some insurance companies apply the discounts to both the automobile and also the homeowners/renters policy. Speak to your representative about multi-policy price cuts. It's no key that the much better your driving document, the much less you will certainly spend for auto insurance policy.

Numerous vehicle insurance providers are in fact a collection of several insurance companies in which each satisfies a particular kind of vehicle driver. The most awful vehicle drivers enter one firm, the very best in an additional, and a great deal of individuals end up in one of the center companies. These center individuals pay much less than the most awful vehicle drivers, but greater find this than the most effective.

Unknown Facts About Insurance

Yet these middle individuals are paying a lot more. Why? The normal reason is that they do not understand any far better. No person told them which insurer in the group had the Read Full Article very best costs. And also, odds are, no person also told them there was a group of insurer. If you have a spick-and-span driving record, there's no reason you should not be paying the least expensive cost a team of insurer has to supply.

What Does Insurance Do?

Generally, the much more metropolitan the location, the higher the costs. The expenses can differ even within an area. Prices can differ significantly from state to state. As an example, somebody living in New Jacket, Massachusetts or Hawaii pays numerous times much more, usually, than a person in North Dakota, South Dakota or Idaho.

8 Simple Techniques For Insurance

Many insurers currently use your credit rating background as a significant consider establishing what to charge you for auto insurance. Sometimes, with some companies, you might conserve money by changing your service to an insurance provider that uses credit history as a rating aspect even if you have a moderate or bad driving record.

If you have an inadequate credit background, you might save cash by moving your auto insurance to a firm that does not make use of debt as a ranking factor. Several insurance companies do not utilize credit scores as a factor. Despite your credit history status, you need to speak to your representative to see to it you have the very best scenario given your credit document, good or negative.

The Definitive Guide for Insurance

Many companies give a price cut for the added company. It's not simply for car insurance coverage; according to Bankrate, you can also save by packing house or occupant's protection with your cars and truck insurance policy. Allstate offers a 25 percent discount on homeowner's protection and also a 10 percent automobile price cut when you incorporate both plans (insurance).

On the other hand, moving infractions that carry factors Home Page on your driving record, such as speeding, will additionally elevate your vehicle insurance costs. The deductible is the amount of money you pay out of pocket if you have a car insurance coverage case.

What Does Insurance Do?

You could be able to conserve cash on auto protection with unadvertised discount rates. As an example, ask regarding conserving money for association with certain teams, choosing on-line policy info, or paying your whole premium price beforehand. Contrast the discount rate prices with those from other insurance providers to obtain the most effective offered price - insurance.

Some states also need insurance companies to supply this type of discount. Price isn't everything when it comes to selecting the best automobile insurance policy firm.